As the largest law firms vie for the new wave of junior solicitors, the battle for talent is becoming more intense than ever before, but what is the trajectory for this ever-escalating bidding war? Where did it begin, and what does it mean for the best of the newly qualified talent now?

After experiencing a difficult period of economic uncertainty that encompassed the Brexit vote and the first 12 months of Covid, the legal sector has bounced back spectacularly, and the market for junior lawyers is currently white hot. If you didn’t see it on the BBC website last week, you may be interested in this article which explores the battle for talent and touches on the plight of NQs earning £150,000 per annum.

Anybody who has spent time with a large international law firm will know that while they invest heavily in the recruitment and retention of talent through non-salary elements—generous benefits packages, L&D opportunities, onsite doctors and dentists—the easiest way to attract the ‘brightest and best’ is to simply whack another £10k on their salaries. After all, nothing talks louder than cash!

But what drives this need to increase salaries by such margins? While we’re no experts when it comes to economics, we’re aware of the basic concept of supply and demand—and there’s certainly no shortage of supply when it comes to junior lawyers.

Looking Back: A Story of Salaries

To understand where we are now we need to look at what’s gone before, so let’s turn our minds back to 1987 and the merger of Coward Chance and Clifford Turner to form—you’ve guessed it—Clifford Chance.

This was a merger that sent shockwaves through the legal world, and many would argue that it fired the starting pistol in the race for global domination—in respect of the provision of legal services anyway.

Fast forward a decade to 1997, and NQs within the magic circle were pocketing an average of £30,000 per annum (which equates to c. £58,000 today). The highest NQ salary in London (£45,000) was being paid by one of New York’s finest, White and Case.

In 2010, Boston headquartered and financial restructuring heavyweight, Bingham McCutchen, became the first firm to break through the £100k barrier, but they were far from the only firm to play along. 2010 was an exceptional year for salary growth, with magic circle qualifiers getting a c. 20% rise.

Bingham didn’t stop there either; they doubled their NQ salary in just four years, and four years later the firm tore itself apart and 300 partners disappeared to Morgan Lewis.

The current flare up in the battle for talent started just prior to the pandemic, when several leading firms announced double digit increases in their NQ salaries, only to perform an about-turn shortly after we were all sent home. However, once everybody realised that work could continue and 2020 was firmly in the rear-view mirror, it was open season again.

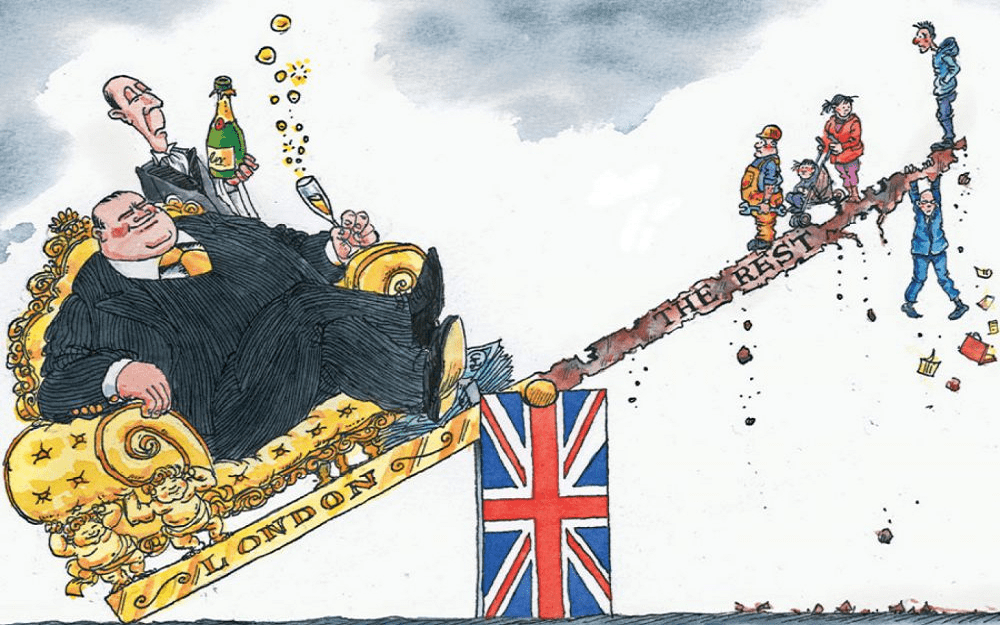

Several of the UK’s largest law firms(not just the magic circle) are now paying their NQs in excess of £100k, while the salaries on offer at numerous US law firms (including Kirkland & Ellis, Skadden and Latham & Watkins) are an eye-watering £150k+.

We think that Vinson & Elkins currently tops the list at £153,300 per annum, but somebody’s probably gone one step further during the 48 hours it’s taken us to publish this blog!

So, if there’s no shortage in the supply of junior lawyers, why is the battle for talent currently so intense?

Pent-up Demand

While there’s no shortage in the supply of junior lawyers, there’s certainly been a significant increase in the demand for their services.

Whatever your views on the current government, it’s hard to argue against the fact that the 80-seat majority won by Boris Johnson in 2019 released a pressure valve which had suffocated the economy and the legal market since the referendum of June2016. However, almost as soon as the valve was released, we were hit with the pandemic, and the legal sector returned to a state of cryostasis once again.

Within a year of the first lockdown, businesses had learned to adapt and—frustrated by four or more lost years—boy are they ready to do some deals!

Replacing Mid to Senior Level Associates

As the BBC article references, recent reports have indicated an increase in the number of experienced practitioners quitting the legal sector.

Whether this is because the pandemic has caused experienced lawyers to simply take stock, or surging demand creating a heightened level of pressure for mid to senior level associates, one thing is for sure: finding like-for-like replacements in the current climate is extremely tough.

This is forcing law firms to replace experienced associates with more junior lawyers to plug the gaps.

Chasing the ‘Brightest and Best’

While we’re currently experiencing exceptionally high levels of wage growth, the battle for talent will always endure because of the way that the sector identifies ‘talent’.

It matters not how academically strong the median law student is, or how well the legal education system prepares graduates for a career in law; top tier law firms will always do what they can to attract the ‘brightest and best’.

As you can see from the historical bigger picture of legal pay, the wheels never stop. Salary increases are inevitable. It doesn’t matter how many first-class trainees qualify each year, there’ll always be a top 2-3% that elite firms will skim off the top.

It appears that the battle for talent has no end, and as salaries continue to climb, we might remember Bingham McCutchen for their pioneering spirit. For the giants that stand on their shoulders offering more than ever, it seems that they are too big to fail.

One thing is for certain, in this waging dogfight to recruit the best of the legal sector, the real victors are the newly qualified solicitors pocketing the payslip.